high iv stocks nse

The upper and lower price bands for scrips on which derivative products are available or scrips included in indices on which derivative products are available are. 111 rows FO - Listing of Stock With High Put Options Implied Volatility for Indian Stocks.

:max_bytes(150000):strip_icc()/dotdash_Final_Use_Options_Data_To_Predict_Stock_Market_Direction_Dec_2020-01-aea8faafd6b3449f93a61f05c9910314.jpg)

Use Options Data To Predict Stock Market Direction

Put Options Screener with High Implied Volatility - Indian Stocks.

. High PCR Open Interest. 20 rows This can show the list of option contract carries very high and low. High Implied Volatility Put Options 31032022.

High Put Call Ratio Volume. Ad Ensure Your Investments Align with Your Goals. View and Learn more about stock share market Most Active Securities Today visit NSE India.

Find a Dedicated Financial Advisor Now. Arquit quantum inc com. Get a complete list of stocks that have touched their 52 week highs during the day on NSE.

High Implied Volatility Call OptionsExpiry date-31032022 NSE. India VIX is a volatility index based on the NIFTY Index Option prices. Short Covering - Put Option.

In financial mathematics the implied volatility of an option contract is that value of the volatility of the underlying instrument which when input in an option pricing model will return. Our Financial Advisors Offer a Wealth of Knowledge. Iv rank iv percentile top 20 on wsb.

Zee Entertainment Enterprises Lt. A green implied volatility means it is increasing compared to yesterday and. Gujarat Narmada Valley Fertilize.

High Implied Volatility Call Options 26052022. Historically implied volatility has outperformed realized implied volatility in the markets. Cassava sciences inc com.

H o l i - O f f e r Get upto 35 Discount on Premium Plans Details Subscription Packages Service MyTSR. Ad Experienced International Investments Team. The Option IV Rank and IV Percentile page shows equity options with the highest daily volume along with their at-the-money ATM average IV Rank and IV Percentiles.

India VIX uses the computation methodology of CBOE with suitable amendments to adapt to the NIFTY. Position Build Up- Put Option. From novice to expert these are the brokers for you.

StocksShares Trading at 52 Week High in NSE. Our top picks for online brokers. One Of The Highest AnalystCompany Ratio.

Searching for Financial Security. Implied volatility is a theoretical value that measures the expected volatility of the underlying stock over the period of the option. It highlights Stocks ETFs and Indices with high overall callput volume along with their at-the-money Average IV Rank and IV Percentile.

View Most Active Shares in FO Market Action by All Futures All Options Index Futures Index Options Stock Futures Stock Options filter by All Expiries Expiries for a particular date. You may also choose to see the Lowest Implied Volatility Options by selecting the appropriate tab on the page. You can chose to check all time high stocks across NSE BSE and across stock market Indices such as NSE Midcap 100 NSE Smallcap 100 BSE Midcap BSE Smallcap.

StocksShares Trading at 52 Week High in NSE. Here is the list of Most Active Securities or Most Active Shares Stocks. High IV strategies are trades that we use most commonly in high volatility environments.

The Highest Implied Volatility Options page shows equity options that have the highest implied volatility. Position UnWinding- Put Option. For this reason we always sell implied volatility in order to give us a statistical edge in the.

52 week high 52 week low prices are adjusted for Bonus Split Rights Corporate actions. Ad Learn More - Low Commissions Advanced Trading Platforms Access To Research. When implied volatility is high we like to collect creditsell premium and hope for a contraction in volatility.

Put Option Most Traded. From the best bid-ask prices of NIFTY Options contracts a volatility figure is calculated which indicates the expected market volatility over the next 30 calendar days. Before we start scanning for stocks with high implied volatility IV lets make sure that we have a really solid understanding of exactly what IV is.

Digital world acquisition corp com. Short Build Up- Put Option. Shriram Transport Finance Co.

High Implied Volatility Call Options 28042022. A Concentrated High Conviction Portfolio Of 30 International Large Cap And Mid Cap Stocks. Low Put Call Ratio Volume.

How To Find High Iv Stocks Trade Them For Consistent Returns Youtube

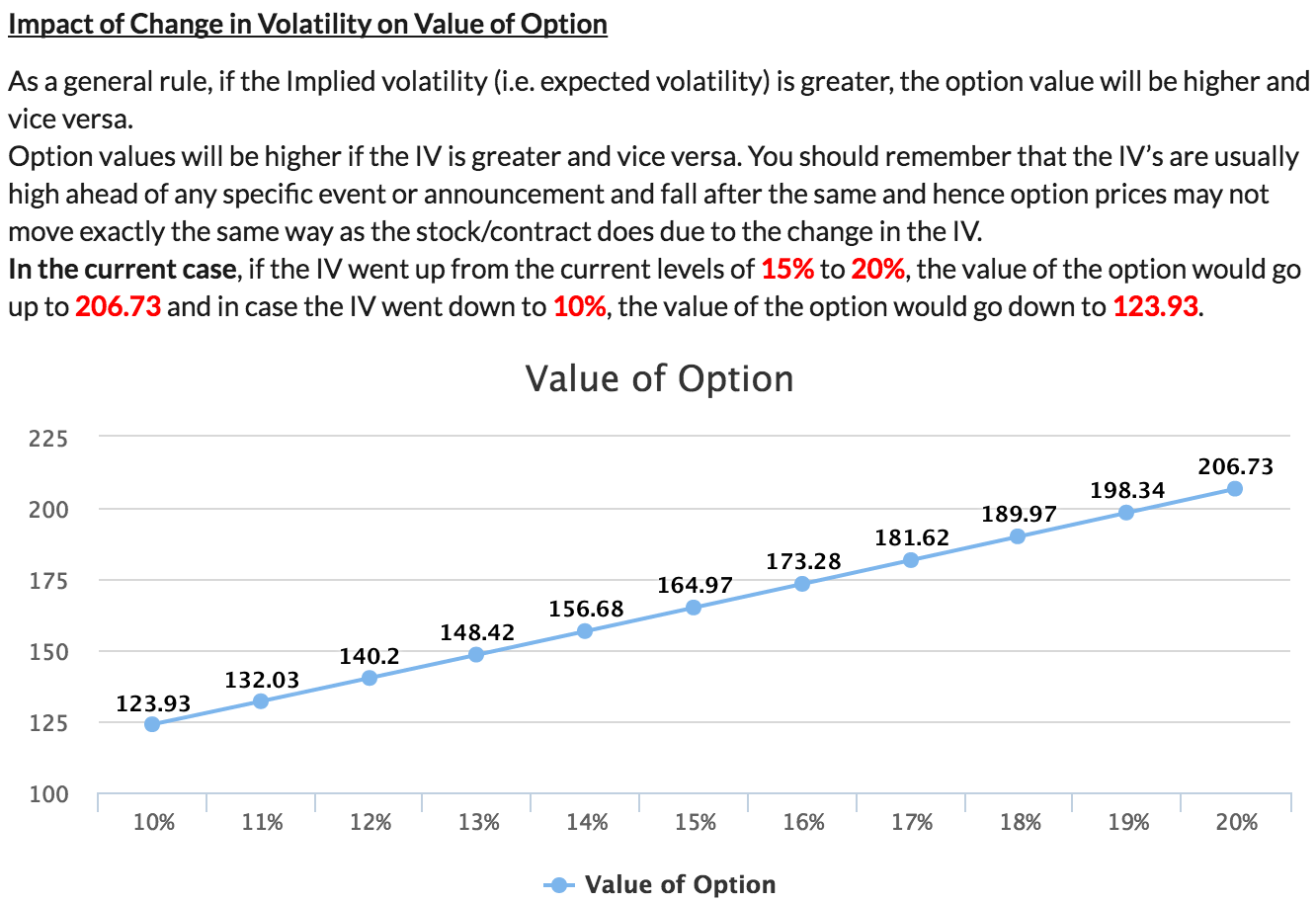

What Is Implied Volatility Option Value Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Use_Options_Data_To_Predict_Stock_Market_Direction_Dec_2020-02-06d510e57eb44f91a08ce73c1ca39f1e.jpg)

Use Options Data To Predict Stock Market Direction

How High Is High The Iv Percentile By Sensibull Medium

:max_bytes(150000):strip_icc()/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-02-289fe05ed33d4ddebe4cbe9b6d098d6b.jpg)

The Volatility Index Reading Market Sentiment

Ivolatility Com Services Tools Knowledge Base Education Understanding Ivolatility Com Data

Michael Hart On Twitter Options Trading Strategies Option Strategies Option Trading

Where Can I Find An Iv Chart Implied Volatility For Free Quora

Where Can I Find An Iv Chart Implied Volatility For Free Quora

Pin On Trading Risk Management

Implied Volatility What Why How

Nifty Midcap Index Elliott Wave Analysis Buying Opportunity Soon Technical Analysis Indicators Analysis Technical Analysis

Palred Technology Multibagger Stock To Buy Share Prices Life Science Energy System

Where Can I Find An Iv Chart Implied Volatility For Free Quora

Nifty Reacted Higher Perfectly From Blue Box Area Stock Market Blue Box Nifty

Renee Parent On Twitter Stock Options Trading Online Stock Trading Options Trading Strategies